Future Coal Supplies - More, Not Less!

By Dave Summers

Posted by Heading Out on November 24, 2010 - 11:57am

Topic: Supply/Production

There has been a growing trend toward predicting an imminent peak to the production of coal. Just this last week Nature carried an article that précised Richard Heinberg’s recent book on Coal production, which I reviewed when it first came out. And while that was based, in turn, on David Rutledge’s application of Hubbert Linearization to coal production, (discussed here ) that underlying theme had also been picked up in an article in Energy by Tad Patzek. This latter paper had just come out when, at the beginning of last month, I gave a paper at the ASPO-USA meeting explaining why the approach was wrong. I did that with Kjell Aleklett sitting in the front row of the audience; his graduate student Mikael Höök had just presented a dissertation along the same lines.

Why am I so obdurate that this is wrong, in the face of such heavyweight opinion? Well let me run through the bones of my argument to explain why.

The most extreme of the positions on the imminent coal peak is that of Tad Patzek and Greg Croft. (Energy, Volume 35, Issue 8, August 2010, Pages 3109-3122) In that paper the authors had inserted a predictive graph on coal energy production rate, as follows:

From Patzek and Croft

As you may note, this suggests that we are right at that cusp of peak production and it is all downhill from here. With the major sources of energy for the planet currently coming from coal and oil, and with the recent comments both from the IEA and the Joint Services Command about the peaking of oil, that would transfer a lot of the load to natural gas, which is the third major source, according to the IEA. (And it should be noted that P&C did include the following from the IEA in their presentation.

IEA predictions of future energy supply sources (after P&G)

Gregor Macdonald at Seeking Alpha has recently highlighted the increasing world consumption of coal, which is rising much more rapidly than that of oil, which has almost stabilized. Much of that demand is coming from China, India and the growing economies of Asia.

Gregor MacDonald

Much of the argument however for peak in production begins with the decline in the production of British coal. Famously, before the first World War, Winston Churchill converted the British Navy from the use of coal to that of oil, despite the UK having, at that time, no known indigenous oil supply yet having plenty of coal. It was a decision followed by Navies around the world. Britain still had the coal, - there were other reasons for the change.

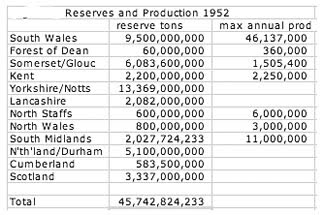

Following the Second World War Britain had to rely on coal as a domestic and industrial fuel, and, in 1947 it nationalized the mining industry. As a part of that process it carried out a detailed physical inventory of the coal reserves of the country. That inventory has been published, and can be summarized in this table:

(From Trueman)

In the post-war years British coal production peaked at about 220 million tons a year in 1955.

British coal levels (Source Open University)

Current demand, as you may note, is just over 50 million tons a year – which might suggest that the UK has about 900 years worth of coal available.

But that is apparently not the case. If you look at a couple of data points, the World Coal Outlook, and then the BP estimate of reserves for 2005, there is nowhere near that amount of coal in the reserve:

The story is told in the difference between the resource and the reserve. At the present time folk would have you believe that the UK has very little coal left (4.5 years according to the BP report, from 2005, which suggests that the country is only staving off running out, since it is using about a quarter of that a year, by relying on imports).

So where did the coal go? Did some evil Voldemort-type character sneak into the country over night and magic it away? No! As the World Coal study shows, the coal is still there. It is just that, at the present time, the coal is not economically mineable and so it is not considered a reserve. It is, however, physically, still there, and thus, is still shown in the first column as a resource. And as the price of oil rises and the price of alternate fuels rises, so more of that resource will become a reserve. As a single example there has been talk of putting a new underground mine in at Canonbie in Scotland as part of a long-term plan to supply the Longannet power station.

It is thought that deep seams run for miles underneath the Canonbie area and could yield 400 million tonnes of coal, enough to keep the Longannet power station going for the next 80 years.

You may note that the 400 million ton figure is twice the volume that BP considered the totality of the British Reserve in 2005.

The predictions of the imminent death of the Coal Industry are likely thus to be somewhat premature.

Now let me close by addressing two other points. One of the technical advances that moved so much of the British reserve into the resource column instead was that it became, with the advent of larger mining equipment, much cheaper and simpler to mine coal from the surface deposits of places such as Wyoming or Queensland, than it did to mine it from underground. When the basic technology is not much more complex than using larger and larger shovels to dig the coal out of the ground there is, as yet, no need for the more complex technologies that might, at greater expense, make more of the coal a reserve, rather than a resource. The world has more than enough coal, and coal producers that its price is largely kept down by competition. (Technology was the second part of my ASPO paper, though I will forego going down that part of the argument in this post).

Consider, for example, that until recently Botswana found that it was cheaper to buy the power that it needed from South Africa, rather than expand its own coal-fired power system. Then South Africa decided it needed that power itself and so Botswana was thrown back on its own resources. It is expanding its sole coal mine and installing additional power stations to raise generation from 120 MW to 820 MW. In the process they have established that the coal deposits in the country may well be up to 200 billion tons of coal. However, since there is not that much demand, as yet, and Botswana is a land-locked country only 17 billion tons are currently counted as a reserve. However there was a strong Chinese presence during my visit there, and the situation may therefore change.

I won’t comment much on the growth of coal in China, which is moving toward consuming about half the world’s production, Euan Mearns has just covered that in a much better way than I might. But I would add some thoughts to his post.

Firstly the Chinese have been building a lot of coal-fired power stations, and are unlikely to have built any of them without an assured supply of coal for each. Secondly this is not the only market for coal in China. I was in Qinghai province, over by Tibet. The province gets most of its power from hydro, but uses coal to power the brickworks that are ubiquitous in the region, as dwellings are being converted from mud-brick to fired brick.

China has a domestic problem to keep the many regions happy with the central government, and this is causing them to put in massive amounts of infrastructure to allow access to all regions of the country. It is at a scale much greater than that I have seen anywhere else, even in remote regions, such as some of those I travelled. Rail and truck transport of coal is not the only way it can be shipped. Coal pipelines are an alternate way of doing it, but oddly, whenever the technology reaches a point of serious discussion freight costs seem to reduce, at least temporarily. I do not see, therefore, that over the longer term, coal supply to the various power plants being as great an issue as others foresee.

My overall conclusion is, therefore, that there is plenty of coal. The price is kept down by its international availability, and because it is so ubiquitous I anticipate that as oil becomes more expensive, so the nations of the world will, increasingly move to using this as an available reserve.

Future Coal Supplies - More, Not Less!

No comments:

Post a Comment